Did you know the Department of Human and Health Services (HHS), in 2021, fined $135.3 million in penalties for violating regulatory compliances in virtual care?

Well, this is not the first time HHS has fined healthcare practices. In fact, in 2018, for violating HIPAA compliance, HHS fined penalties worth $28 million. As the adoption rate of virtual care increases, more healthcare data will be prone to data security threats.

In this blog, let’s see what the key regulatory compliances for your chronic care management software are and how to navigate smoothly through the regulatory landscape.

Key Regulatory Standards

There are four major key regulatory standards that you are bound to follow to develop robust chronic care management software. Let’s discuss that in detail below:

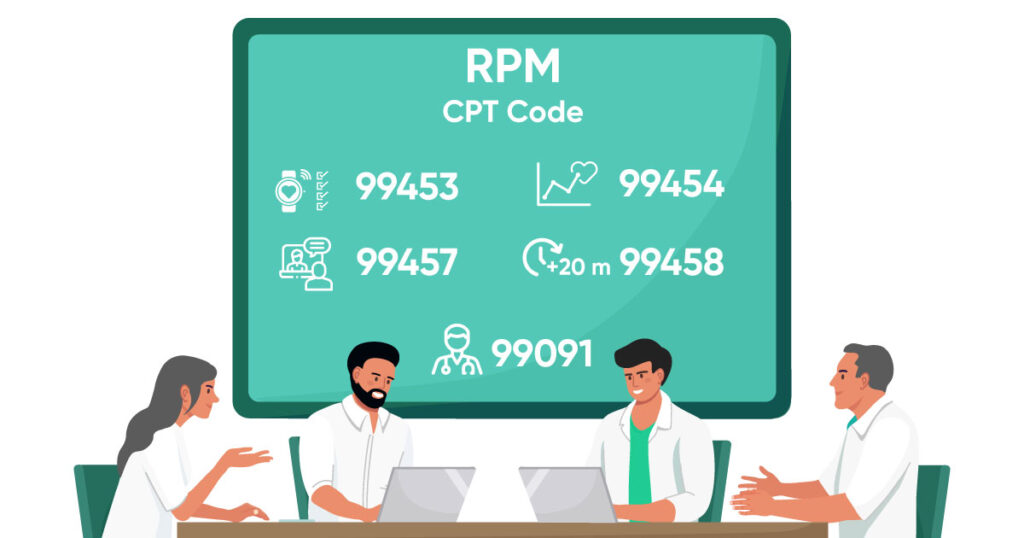

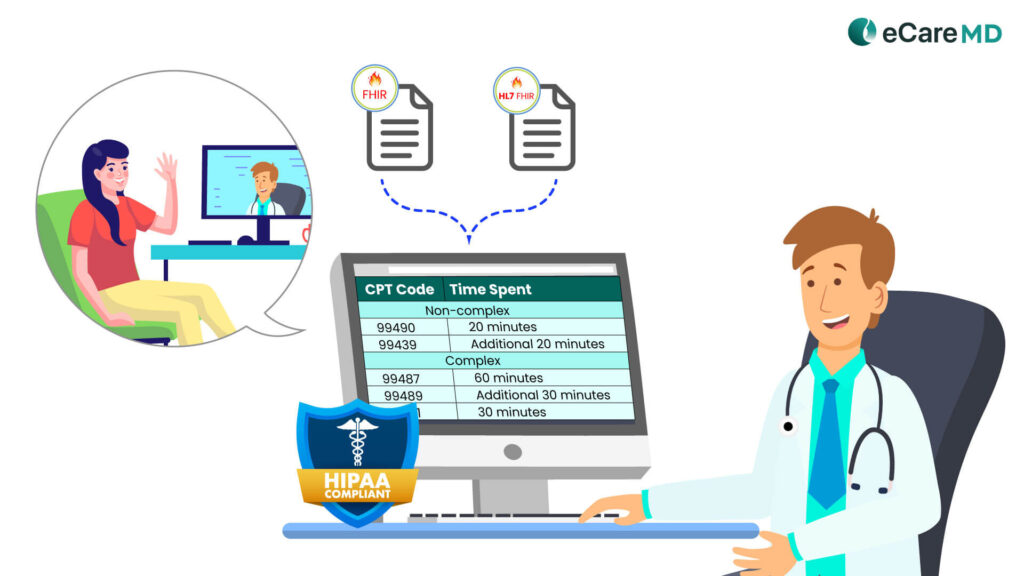

1. Medicare’s Chronic Care Management Service Code:

This means the chronic care management software should support and include CPT codes practice for billing. Below are the CPT codes dedicated to the CCM program as per complex and non-complex chronic conditions:

Non-complex

- 99490

- 99439

Complex

- 99487

- 99489

- 99491

2. HIPAA and Protected Health Information (PHI) Requirements:

Here are some important rules you can keep in mind during the chronic care management software development process:

- The HIPAA Privacy Rule

- The HIPAA Security Rule

- The HIPAA Breach Notification Rule

- The HIPAA Transaction Rule

- The HIPAA Enforcement Rule

- The HIPAA Identifiers Rule

- The Omnibus Rule

Free Step-by-Step HIPAA Compliance Checklist

3. Meaningful Use and Interoperability Standards

4. Additional State and Regulatory Considerations:

Apart from that, in 2023, the states of Colorado, Hawaii, and Nevada passed new payment parity requirements. Click here to read about them in detail.

Choosing Compliant CCM Software

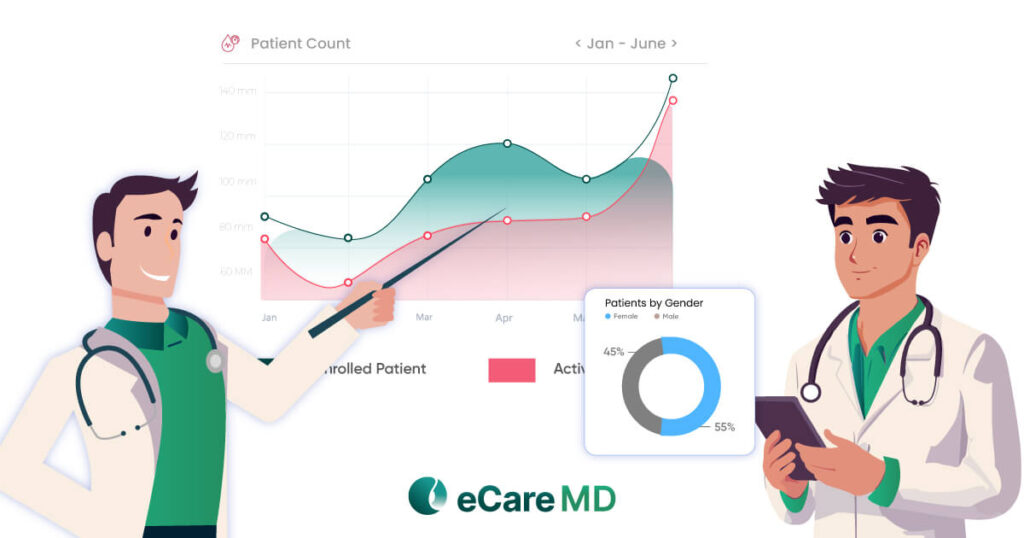

When choosing a compliant chronic care management software, it is important to understand the features that it provides. As features define the functionality of the software, a keen interest in its functions can help you streamline compliance with best practices. This way, you will not only get an idea about the functioning of the software but also bridge the compliance gaps if there are some left to address.

You can get an idea of whether the software is compliant by checking its data storage type. Since most of the CCM software nowadays uses cloud-based data storage for security, it majorly solves the security problems.

Along with that, audit trails and automated reporting features can give you even deeper insight into the activity of the software. While audit trails can ensure authorized access to patient health data, automated reporting can maintain transparency in the practice.

However, if you are going ahead with a custom chronic care management software development, then evaluating vendor compliance practices can prove to be crucial. It is recommended to discuss the strategies vendors implement to achieve compliance and data security.

Despite all this, understand that the technological landscape is changing, and that is forcing the regulatory bodies to update on a regular basis. Staying up-to-date with the updates can ensure the software is always compatible and compliant.

Implementing Compliance Best Practices

- Effective Training and Education: For optimum and correct use of the software, it is important to provide effective training and education to the users. Provide hands-on training to the healthcare staff, including providers, about data management, documentation, and the necessary security protocols.

- Conduct Regular Internal Audits: One of the best practices to check the proper functioning of the software is by conducting internal audits. The results will provide you with deeper insights into the software’s usability and identify potential breaches and problems in the software functionality. Maintaining

- Documentation and Reporting: Along with education and internal audits, maintaining accurate documentation and reporting should be given equal importance. Since CMS requires detailed and accurate documentation of care plans, patient-provider encounters, patient consent, etc., it can help you comply with CMS regulations and streamline billing practices.

Conclusion

In the changing digital landscape, where data is considered to be the new-age currency, safeguarding it to maintain its integrity is crucially important. Especially in this rapidly changing digital healthcare landscape where everything seems to be interconnected, abiding by the compliances and regulatory requirements has been a necessity.

Let this compliance and regulatory guide help you navigate through the necessary requirements. This guide will help you in choosing the right CCM software and give you a brief overview of the necessary compliances that you need to prioritize.

Free Guide to HIPAA-Compliant Chronic Care Management Software

Download NowFrequently Asked Question’s

Here are some of the regulations you need to follow to make your CCM Software compliant:

- Centers for Medicare & Medicaid Services (CMS) Guidelines

- HIPAA (Health Insurance Portability and Accountability Act)

- EHR Incentive Programs

- State Licensing Regulations

- Vendor-Specific Regulations

You can ensure HIPAA compliance for your CCM software by thoroughly reviewing vendor documentation and assessing security features like access control, data encryption, audit logs, incident response plans, etc.

The patient’s protected health information can be generally collected and shared through the chronic care management software. This data usually consists of the patient demographics, billing information, medication history, medical history, etc.

Failing to adhere to the compliances and regulations can result in heavy fines and reputation damage for the provider.

You can choose a CCM software with strong compliance practices by reviewing their compliance best practices and checking for their certifications.

Key regulations for chronic care management software are:

- HIPPA (USA)

- GDPR (European Union)

- State Specific Regulations

- CMS Regulations

- HITECH

Here is how you can assess your CCM software compliance risk assessment:

- Identify legal and regulatory requirements

- Review and document current practices

- Evaluate the risk

- Prepare a risk management plan

- Implement controls

- Monitor and review